Young Adults Are Turning to Cash — Is Your Business Prepared?

A curious trend is emerging amidst the evolving financial landscape: Gen Z's affinity for cash transactions. As living costs surge, younger generations are embracing cash as a preferred method of payment. This shift holds implications for businesses across industries, requiring them to adapt their strategies to accommodate this changing transaction dynamic.

Gen Z's Cash Preference and Its Impact

Amidst rising living expenses, new stats show that 18–24-year-olds are leading a surge in cash usage. Nearly 70% of people in the Gen Z age group report using cash more frequently within the past year, with a significant quarter of them favoring cash for the majority of their transactions. In fact, younger people are reportedly turning to cash stuffing in response to rising costs. These findings are particularly intriguing considering that Gen Z, having grown up in the digital age, is now using cash more frequently than their Gen X counterparts. This shift highlights the potential for increased cash on business premises.

These findings are particularly intriguing considering that Gen Z, having grown up in the digital age, is now using cash more frequently than their Gen X counterparts. This shift highlights the potential for increased cash on business premises.

Adjusting Retail Strategies

The surge in cash-centric transactions prompts a need for retailers to recalibrate their operational strategies. Adapting to this changing landscape involves finding a harmonious balance between traditional and innovative approaches. Businesses must ensure seamless customer experiences while accommodating the uptick in cash usage.

How to Adapt to Gen Z Cash Trends

To navigate the evolving transaction landscape, retailers can proactively embrace strategies that accommodate the young adult generation’s growing use of cash.

Empower Employees through Training

With an influx of cash transactions, it's crucial to ensure that employees are well-versed in efficient cash handling techniques and security protocols. Providing comprehensive training equips staff with the knowledge to accurately count, verify, and store cash. Training programs should cover areas such as:

- counterfeit detection

- accurate cash reconciliation

- maintaining best practices during peak hours

Educated employees not only reduce the likelihood of errors but also contribute to a smoother and faster checkout process, enhancing the overall customer experience.

Leverage Advanced Cash Handling

Infrastructure Investing in modern cash counting and sorting solutions, such as cash recyclers, streamlines manual cash processing. These automated systems offer validation, sorting, and accurate counting capabilities, minimizing errors. Innovative in-store depository solutions like smart safes provide secure cash storage, enhancing operational efficiency and employee morale.

Use Provisional Credit

Provisional credit, available through banking partners for cash deposited into smart safes or recyclers, expedites fund availability for business operations. Overnight access to deposited cash streamlines processes and reduces administrative delays associated with physical deposits.

Strengthen Security Measures

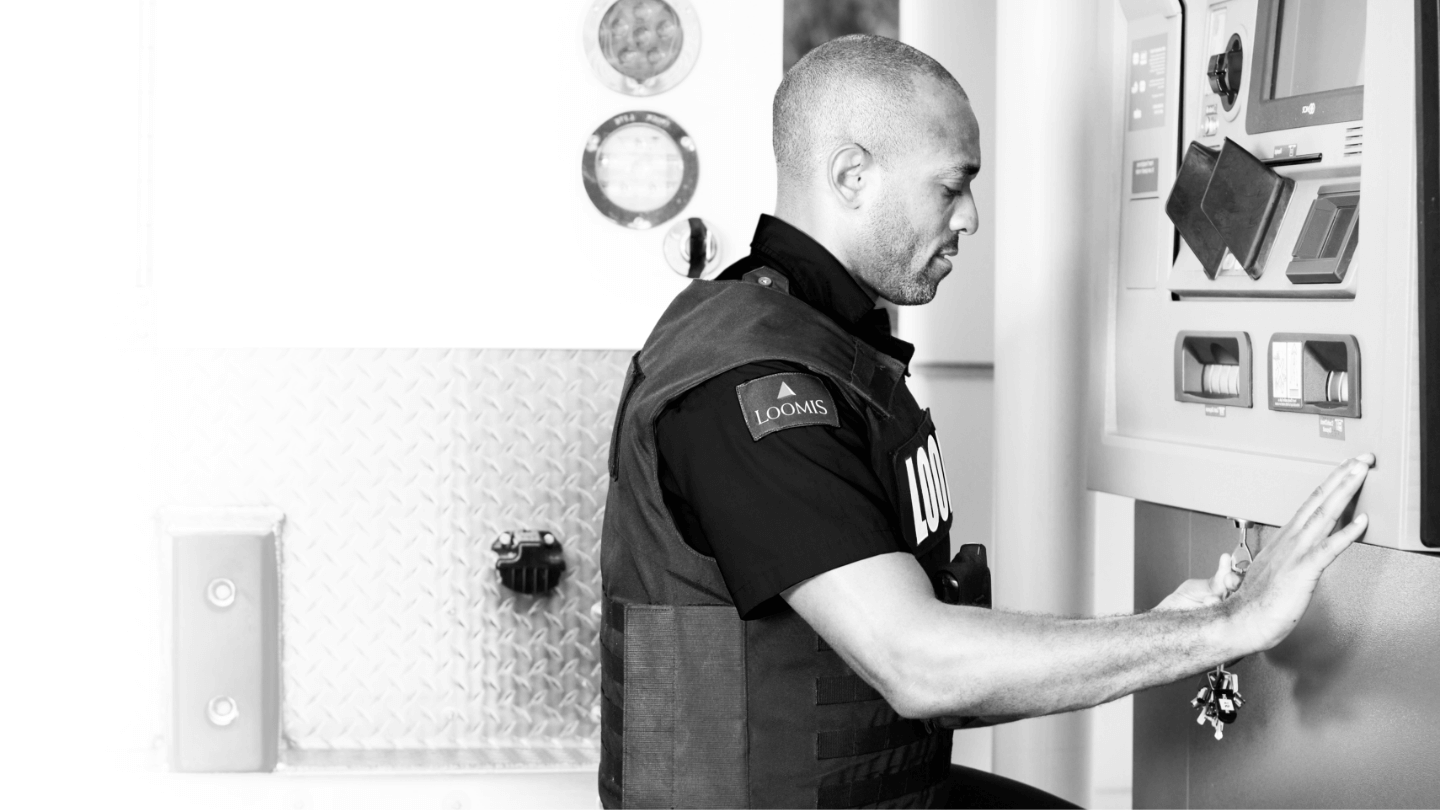

With more cash on hand, security becomes paramount. Implementing robust security protocols, including surveillance systems, access controls, and secure transport services for cash deposits, discourages theft and ensures a safe environment for employees and customers. Regular security training enhances risk awareness and educates employees on vulnerability minimization, fostering trust and positive experiences.

Cash Handling Solutions

In a dynamic financial landscape, partnering with cash handling experts like Loomis can optimize cash handling processes, mitigate security risks, and streamline operations. Loomis' specialized expertise ensures businesses can effectively navigate Gen Z's evolving transaction preferences, embracing change while maintaining security and efficiency. Contact Loomis today to get your business set up for success.

Find out how we can help with your cash management.

Contact Us